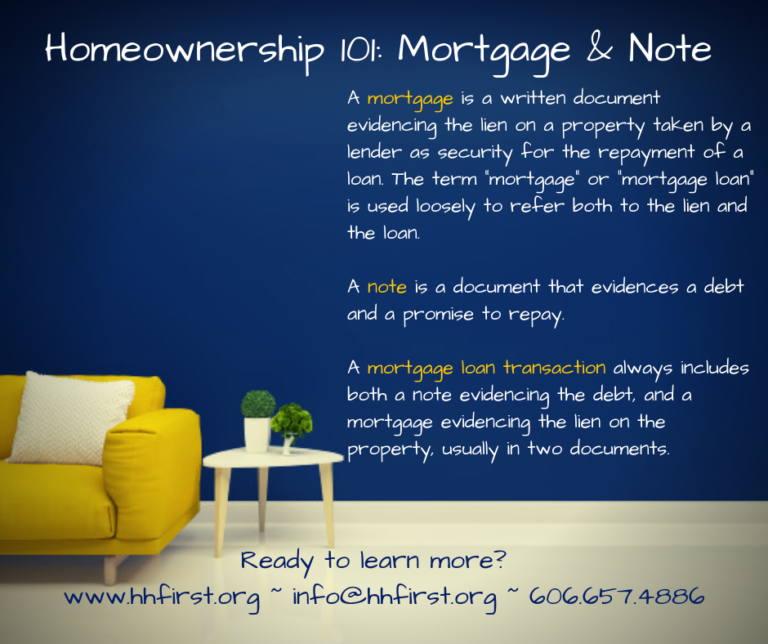

A mortgage calculator can help you compare various mortgages. This calculator will let you compare interest rates, closing cost, and loan terms. You can also select the loan with the lowest cost and the longest term. There are many mortgage calculators to choose from and different lenders offer different loan terms. It is essential to choose the best mortgage calculator to get the best deal.

Comparing interest rates

The mortgage comparison calculator can prove to be very useful when shopping for a loan. These calculators are designed to give you an overall picture of the cost of a loan, and the interest rate charged. It is important that you consider all costs, including taxes and fees. You can also find the annual percentage rates (or APR) of each mortgage. The results of a mortgage comparison calculator can help you determine which mortgage is the best option.

A mortgage comparison calculator is a great tool to help you compare different mortgage rates, loan terms, or monthly payments. Enter your current loan amount, loan term, and interest rate to compare interest rates from different lenders. Then, choose the one that suits your needs best. You can compare two loans using the same mortgage calculator, or several loans with different terms.

Comparing closing cost

A mortgage calculator is a great tool to determine the best mortgage rate and closing cost. Mortgage rates are the interest rate you pay your lender each monthly, while closing costs are the fees the lender must pay. Many times, you can negotiate lower rates in exchange for lower closing fees.

You can quickly compare monthly payments by entering different loan terms in the mortgage comparison tool. The calculator will also show you the interest rate you'll be paying over the life of your loan. This information is helpful when deciding on which mortgage to get.

You should choose the lowest cost loan

Homebuyers should choose the lowest-cost mortgage. Interest rates can impact how much you have to pay each bill. In fact, even 0.25% difference in rates will add at least $14,000 to your total loan over the life of the loan.

FAQ

What is a reverse mortgage?

A reverse mortgage allows you to borrow money from your house without having to sell any of the equity. It allows you to borrow money from your home while still living in it. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers the repayment.

What are the key factors to consider when you invest in real estate?

You must first ensure you have enough funds to invest in property. You can borrow money from a bank or financial institution if you don't have enough money. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

You should also know how much you are allowed to spend each month on investment properties. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be a good idea to live somewhere else while looking for properties.

Can I get a second loan?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

How to manage a rental property

It can be a great way for you to make extra income, but there are many things to consider before you rent your house. This article will help you decide whether you want to rent your house and provide tips for managing a rental property.

Here are some things you should know if you're thinking of renting your house.

-

What should I consider first? Take a look at your financial situation before you decide whether you want to rent your house. If you have any debts such as credit card or mortgage bills, you might not be able pay for someone to live in the home while you are away. Check your budget. If your monthly expenses are not covered by your rent, utilities and insurance, it is a sign that you need to reevaluate your finances. It might not be worth the effort.

-

How much does it cost to rent my home? The cost of renting your home depends on many factors. These factors include location, size, condition, features, season, and so forth. Keep in mind that prices will vary depending upon where you live. So don't expect to find the same price everywhere. Rightmove has found that the average rent price for a London one-bedroom apartment is PS1,400 per mo. This means that your home would be worth around PS2,800 per annum if it was rented out completely. It's not bad but if your property is only let out part-time, it could be significantly lower.

-

Is it worth it? You should always take risks when doing something new. But, if it increases your income, why not try it? Before you sign anything, though, make sure you understand exactly what you're getting yourself into. Not only will you be spending more time away than your family, but you will also have to maintain the property, pay for repairs and keep it clean. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Are there any benefits? There are benefits to renting your home. Renting your home is a great way to get out of the grind and enjoy some peace from your day. It is more relaxing than working every hour of the day. Renting could be a full-time career if you plan properly.

-

How can I find tenants? Once you've decided that you want to rent out, you'll need to advertise your property properly. Start by listing online using websites like Zoopla and Rightmove. Once potential tenants reach out to you, schedule an interview. This will help you assess their suitability and ensure they're financially stable enough to move into your home.

-

What are the best ways to ensure that I am protected? If you fear that your home will be left empty, you need to ensure your home is protected against theft, damage, or fire. You will need to insure the home through your landlord, or directly with an insurer. Your landlord will likely require you to add them on as additional insured. This is to ensure that your property is covered for any damages you cause. This doesn't apply to if you live abroad or if the landlord isn’t registered with UK insurances. In these cases, you'll need an international insurer to register.

-

It's easy to feel that you don't have the time or money to look for tenants. This is especially true if you work from home. It's important to advertise your property with the best possible attitude. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. You'll also need to prepare a thorough application form and provide references. Some prefer to do it all themselves. Others hire agents to help with the paperwork. Interviews will require you to be prepared for any questions.

-

What should I do once I've found my tenant? If you have a contract in place, you must inform your tenant of any changes. If you don't have a lease, you can negotiate length of stay, deposit, or other details. It's important to remember that while you may get paid once the tenancy is complete, you still need to pay for things like utilities, so don't forget to factor this into your budget.

-

How do I collect my rent? When it comes time for you to collect your rent, check to see if the tenant has paid. If they haven't, remind them. Any outstanding rents can be deducted from future rents, before you send them a final bill. You can call the police if you are having trouble getting hold of your tenant. The police won't ordinarily evict unless there's been breach of contract. If necessary, they may issue a warrant.

-

How can I avoid problems? You can rent your home out for a good income, but you need to ensure that you are safe. Install smoke alarms, carbon monoxide detectors, and security cameras. It is important to check that your neighbors allow you leave your property unlocked at nights and that you have sufficient insurance. You must also make sure that strangers are not allowed to enter your house, even when they claim they're moving in the next door.